바이낸스 거래소 회원 가입 방법 수수료 45% 할인 추천인 레퍼럴 코드

안녕하세요. 비트코인에 관심이 있으신 투자자분들이라면 바이낸스에 대해 익히 들어보셨을텐데요.

오늘은 바이낸스 가입 방법과 최대 할인율인 수수료 45% 할인 받는 방법을 알아보도록 하겠습니다.

먼저 PC / 모바일 바이낸스 가입하는 방법을 알아보도록 하겠습니다.

그리고 최대 수수료율인 45% 할인 받는 방법과 기존 가입자들도 할인 받을 수 있는 방법도 알려드리니 차근히 따라 해보시기 바랍니다.

PC/모바일 바이낸스 회원가입 방법

1. 수수료 20% 할인 링크를 통해 접속하기

아래의 링크를 통해 바이낸스를 접속하셔야 수수료 20% 할인 혜택을 받으실 수 있습니다.

수수료 할인을 받지 않고 가입을 진행한다면 추후에 할인 받기 어렵습니다.

바이낸스 수수료 할인 링크 중 20% 이상으로는 바이낸스에서 제공하지 않고 있습니다.

최대 할인율인 20% 보다 더 높은 할인 링크를 보았다면 높은 확률로 거짓이니 주의하시길 바랍니다.

여기서 준비한 링크는 모든 링크 중에서 할인을 받을 수 있는 최대 할인율이므로, 꼭 챙겨가시길 바랍니다.

만약 이미 바이낸스 가입을 하셔서 할인 혜택을 받지 못하는 상황이 있을 수 있습니다.

해당과 관련된 내용은 뒷 부분에서 다루도록 하겠습니다.

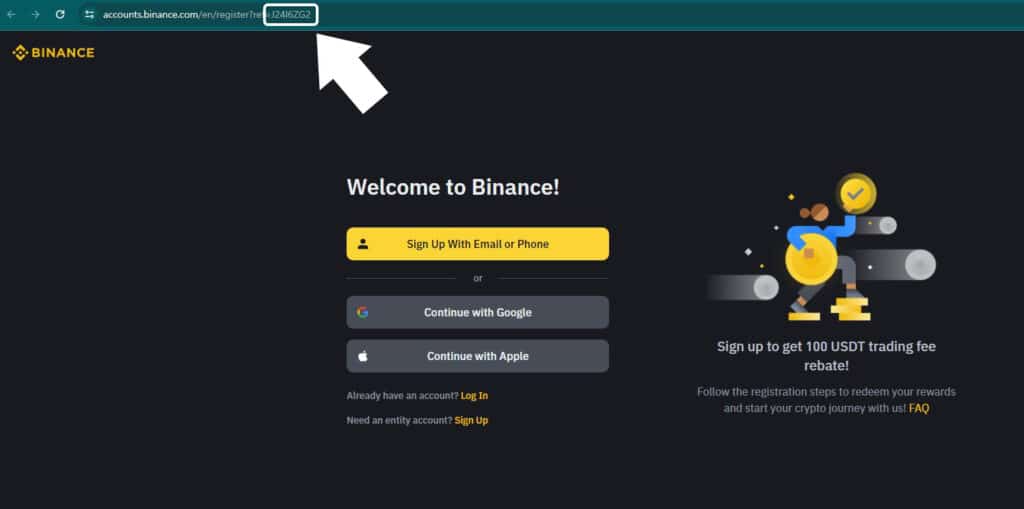

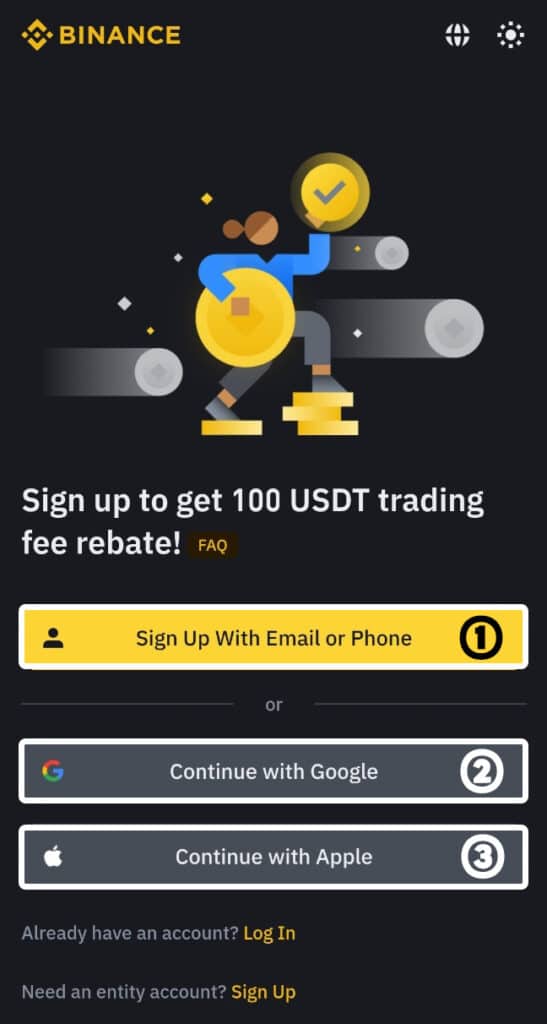

2. 바이낸스 가입 진행하기

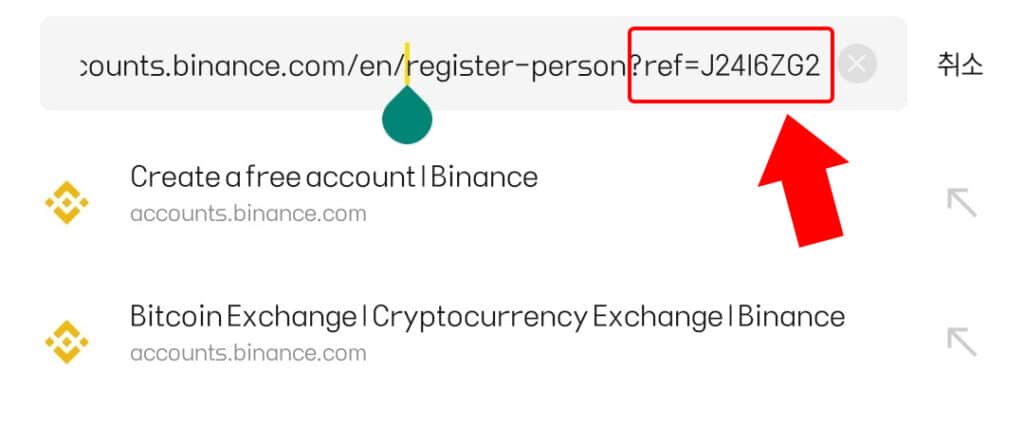

먼저 주소창에 [J24I6ZG2]가 적혀있는지 확인해주셔야 수수료 20% 할인 혜택을 받을 수 있습니다.

모바일의 경우 주소창을 한번 더 눌러주시면 해당 주소의 전체를 확인할 수 있으니, 전체적으로 확인해주세요.

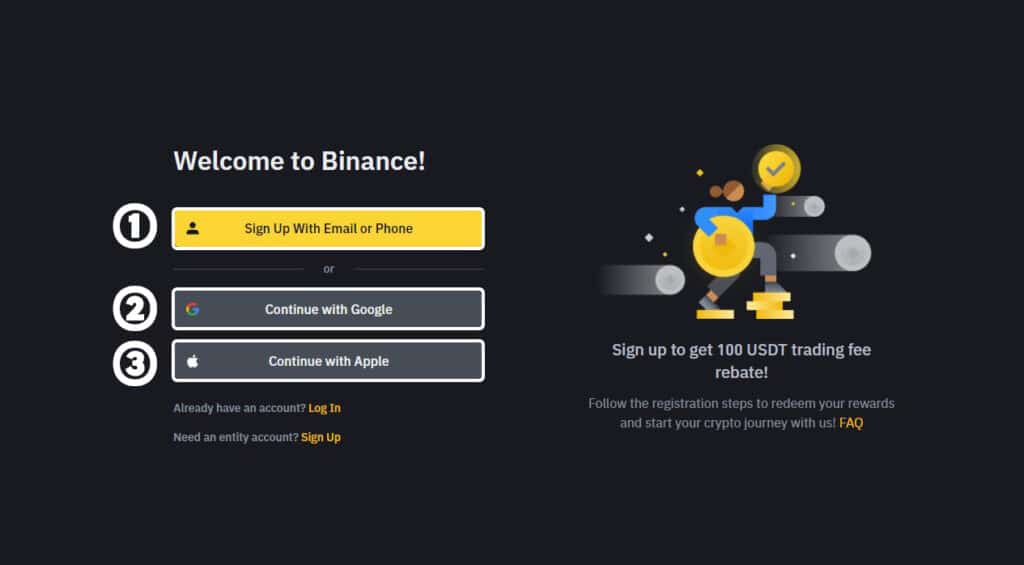

바이낸스 가입하는 방법은 아주 간단합니다. 가입하는 방법이 3가지가 존재합니다.

[Sign Up With Email or Phone]은 이메일 혹은 핸드폰 번호로 가입 하는 방법이며,

[Continue with Google] / [Continue with Apple]은 구글 혹은 애플 계정으로 연동하는 가입하는 방법입니다.

이때, 실제로 사용하고 있는 이메일과 핸드폰 번호를 입력해 주셔야 하며, 핸드폰 가입의 경우 본인의 명의로 가입하셔야합니다.

본인의 명의가 아닐 시에 국내 거래소와 신원이 불일치하여 입출금이 제한이 되므로 이 점 유의해주세요.

만약, 이미 가입을 하셔서 수수료 할인 혜택을 받지 못하는 상황이 있을 수 있습니다.

기존 가입자도 수수료 할인 혜택을 받을 수 있는 방법은 뒷 부분에서 다루도록 하겠습니다.

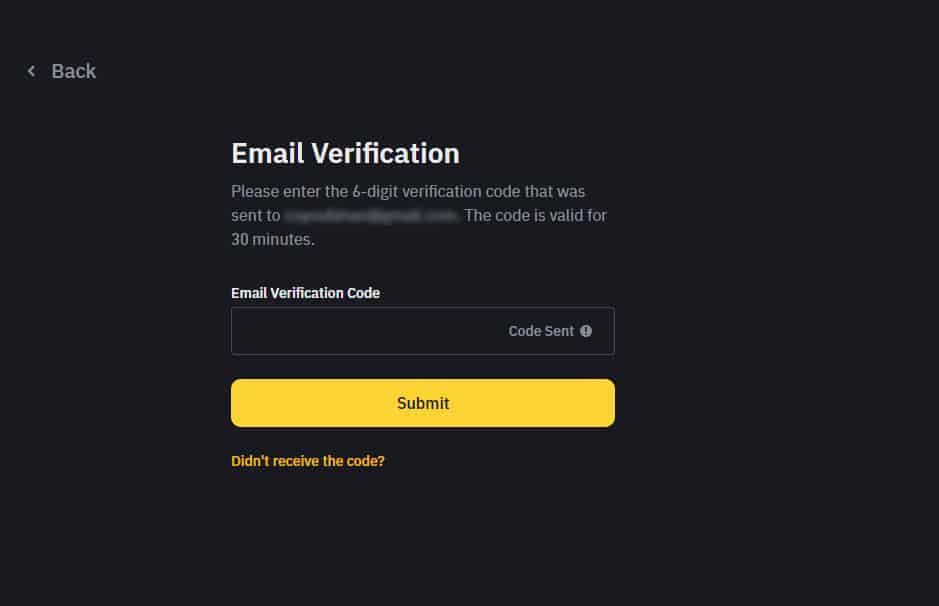

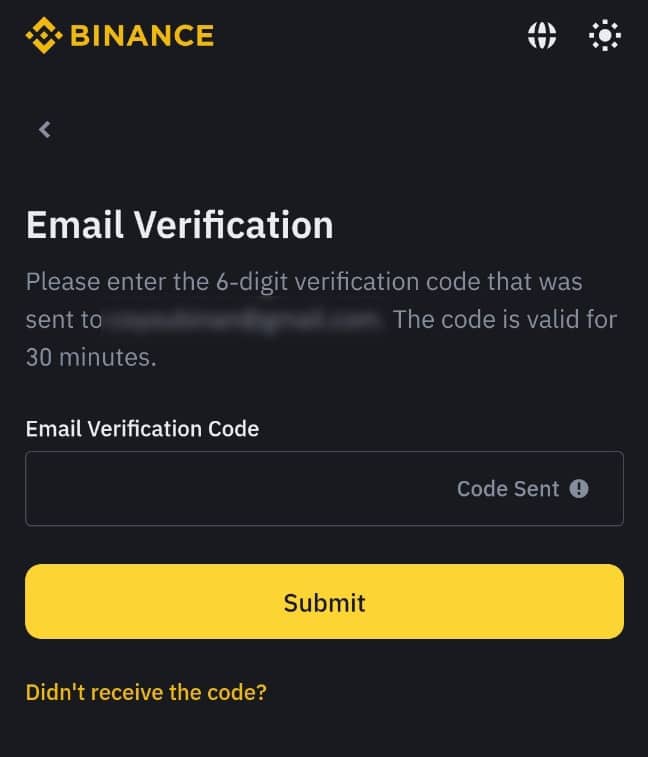

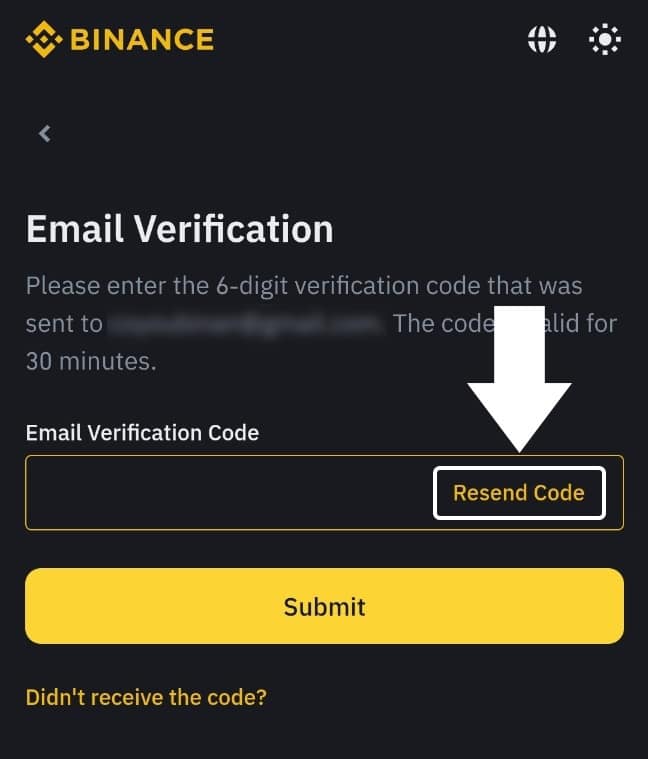

3. 본인 인증 진행

가입을 진행한 이메일 계정 혹은 핸드폰 번호로 6자리의 인증 번호가 전송이 됩니다

인증 번호를 입력해주시고 다음으로 진행해주시면 됩니다.

만약 이메일 혹은 핸드폰 번호로 인증 번호가 오지 않았다면 스팸 메일함 혹은 스팸 메시지 목록을 살펴보시길 바랍니다.

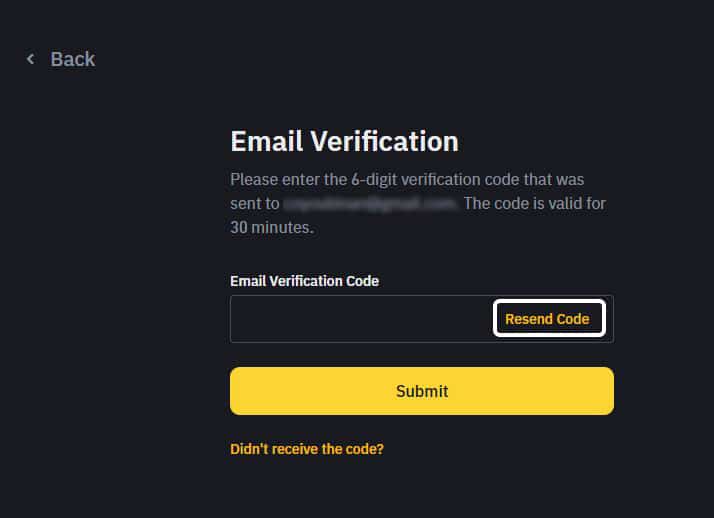

그래도 찾지 못하였다면, 1분 정도 기다리면 Code Sent 항목이 Resend Code로 바뀐 것을 확인할 수 있습니다.

다시 Resend Code를 눌러 인증번호를 다시 받아주세요.

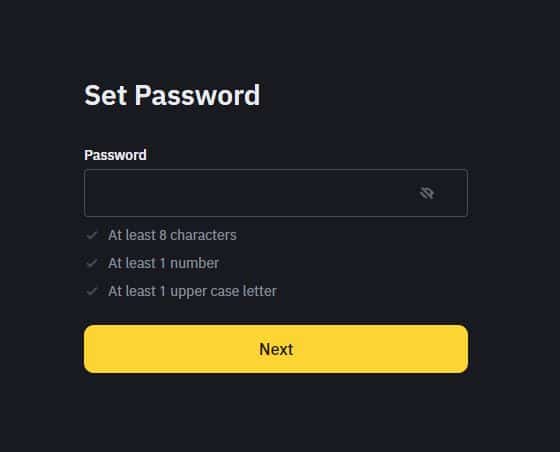

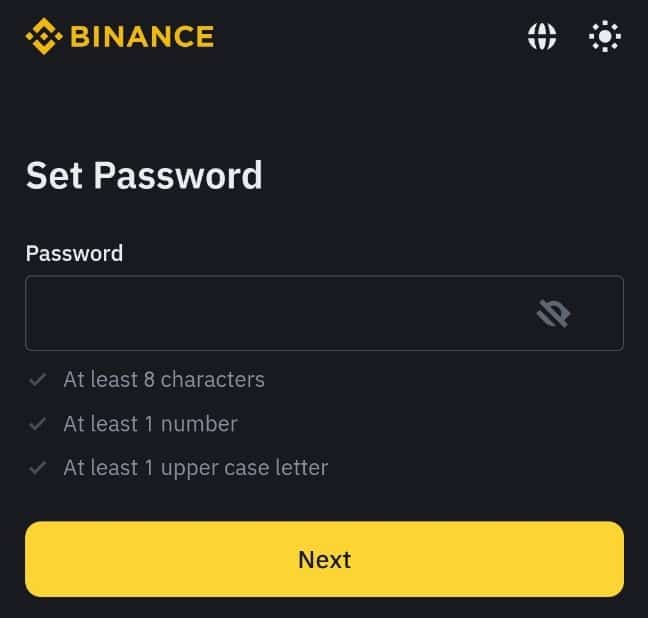

4. 비밀번호 설정

인증 번호까지 입력을 완료하였다면 비밀번호를 설정해주셔야 합니다.

비밀 번호 설정 시에 최소 하나의 숫자와 대문자, 소문자를 포함하여 8자 이상으로 설정 해야합니다.

해당 조건에 맞게 비밀번호를 설정해주세요.

5. PC/모바일 바이낸스 회원가입 완료

비밀번호까지 설정 완료하였다면 수수료 20% 할인 혜택을 받으며 바이낸스 가입이 완료됩니다.

기존 가입자 수수료 할인 받는 방법

수수료 할인 혜택을 받지 않고 가입하였다면 수수료 할인 혜택을 받을 수 있는 방법이 두 가지 있습니다.

하지만 조건이 있습니다. 해당 조건은 KYC를 인증을 진행하지 않았거나, KYC 인증을 진행하였어도 선물 거래를 하지 않은 상태여야합니다.

여기서 KYC는 신원 인증이며, 신원 인증을 진행해야 국내 거래소로 입출금이 가능합니다.

또한 바이낸스는 신원 인증을 필수로 진행해야 원활하게 바이낸스 거래소에서 거래가 가능합니다.

자세하게 KYC에 대해 알고 싶다면, 바로 아래 링크를 통해 글을 참고해주세요.

KYC 인증을 진행하지 않았을 경우

KYC 인증을 진행하지 않았을 경우, 추천 드리는 방법은 바로 재가입 하는 방법입니다.

재가입하는 방법이 제일 빠르고 쉽게 수수료 할인 혜택을 받을 수 있습니다.

KYC 인증을 진행하였을 경우

가입을 진행하였을 때, 수수료 할인을 받지 못한 상황이여야 가능한 방법입니다.

그리고 선물 거래를 진행하지 않은 계정이여야 합니다. 해당 부분은 PC로 진행해야 가능합니다.

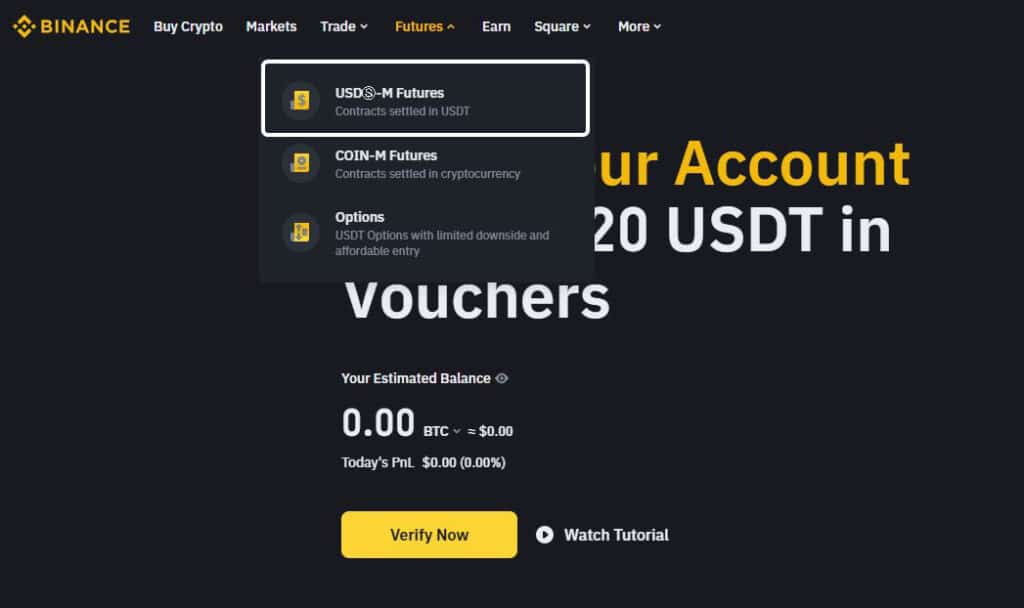

먼저 바이낸스에 로그인을 진행하고, 왼쪽 상단 [Futures] – [USDⓢ – M Futures] 를 선택해주세요.

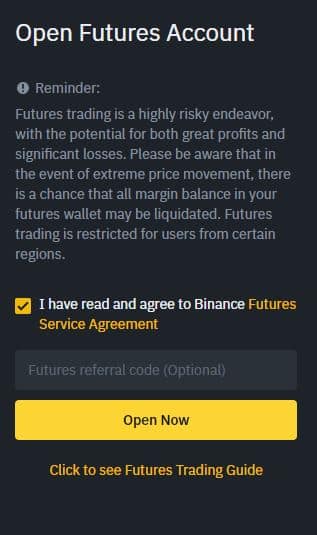

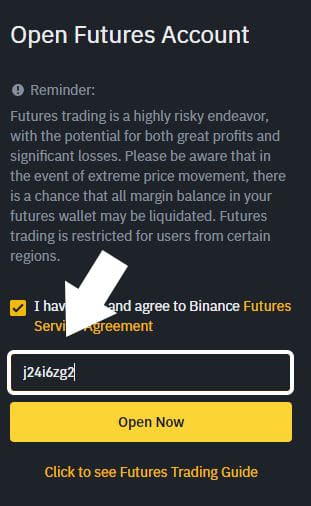

선물 차트 오른쪽에 보면 [Open Futures Account] 에 빈칸을 확인할 수 있습니다.

해당 빈칸에 [J24I6ZG2]를 작성한 후 Open Now를 누르면 수수료 할인 혜택을 받을 수 있습니다.

기존 가입자 중에 수수료 할인 혜택을 받았다거나, 수수료 할인율이 낮은 경우 (10%, 15%) 다시 수수료 할인을 받는 방법은 새롭게 계정을 만들어 20% 링크를 통해 가입하는 방법 밖에 없습니다.

바이낸스 총 45% 할인 혜택 받는 방법

마지막으로 이 방법을 차근히 따라서 하면 총 45% 할인 혜택을 받을 수 있습니다.

바로 바이낸스 자체 코인인 BNB 코인으로 수수료를 지불하면 추가로 25% 할인을 받을 수 있습니다.

PC/모바일 BNB 코인으로 수수료 지불하는 방법을 알아보도록 하겠습니다.

PC 바이낸스 수수료 25% 추가 할인 받는 방법

바이낸스 수수료로 이동

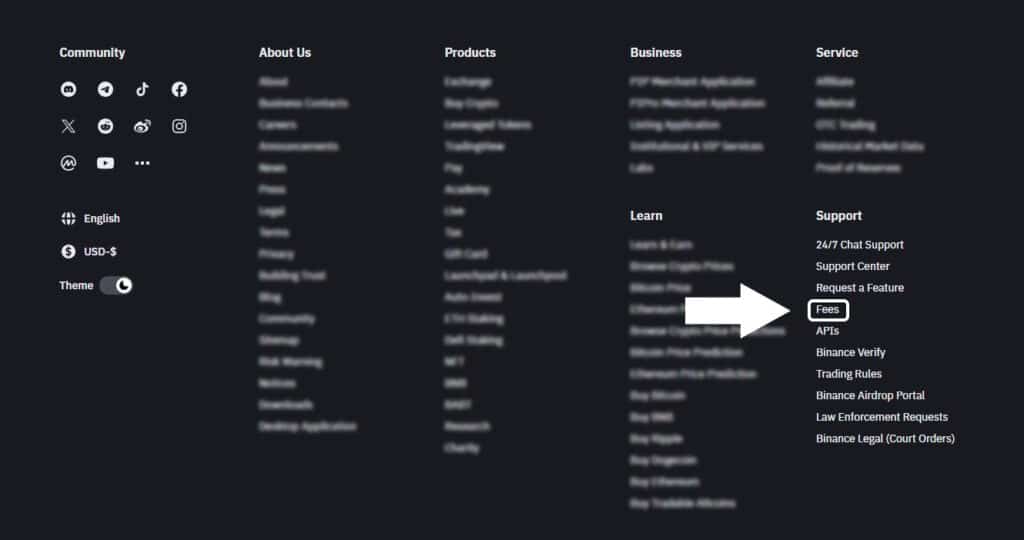

로그인을 한 후 바이낸스 홈페이지 맨 하단으로 이동해주세요.

그러면 여러 항목들이 보입니다. 여기서 [Support] – [Fees]를 선택해주세요.

수수료 BNB 코인 지불 활성화

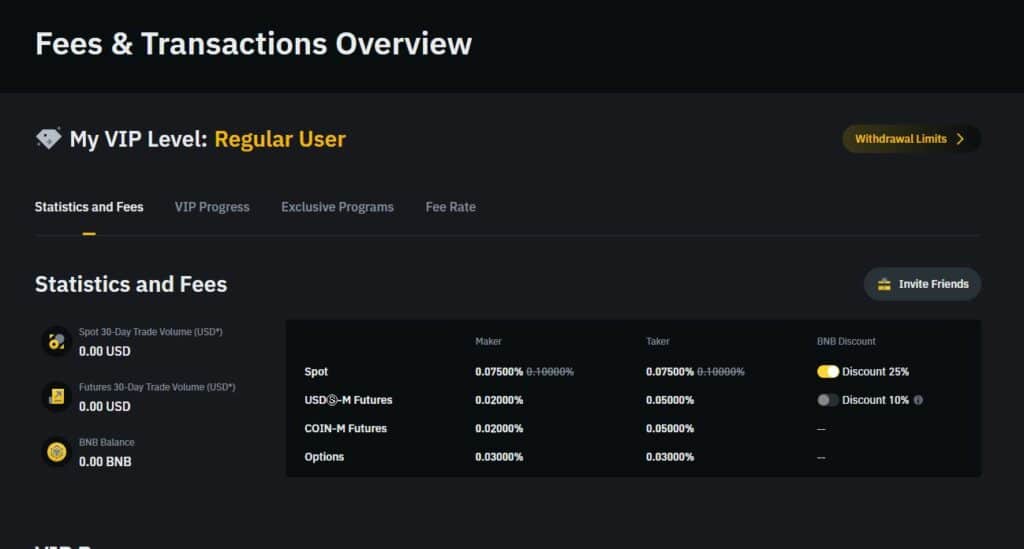

계정의 등급과 함께 [Statistics and Fees]가 보이실텐데요.

여기서 BNB Discount 라는 항목을 찾을 수 있습니다.

Spot, USDⓢ – M Futures 둘 다 활성화 해주세요.

만약, USDⓢ – M Futures에서 BNB 할인이 활성화 되지 않는다면, 활성화 하기 위해서는 BNB 코인을 선물지갑으로 이체해야 하는데요. 자세하게 선물지갑 이동에 대해 알고 싶다면, 바로 아래 링크를 통해 글을 참고해주세요.

이체까지 완료한 후, 활성화 해주시면 총 45% 할인을 받고 있는 것을 확인하실 수 있습니다.

모바일 바이낸스 수수료 25% 추가 할인 받는 방법

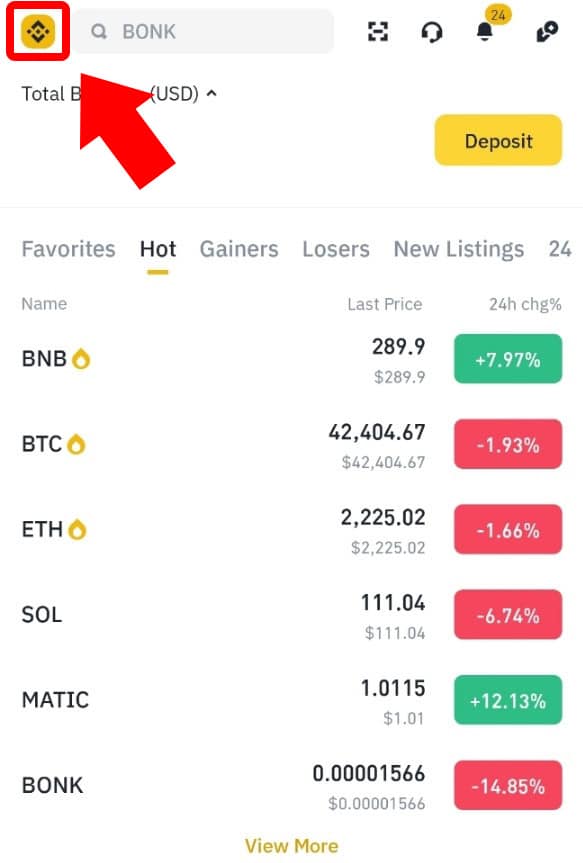

바이낸스 어플에 접속하기

로그인을 한 후 왼쪽 상단에 있는 바이낸스 로고를 선택해주세요.

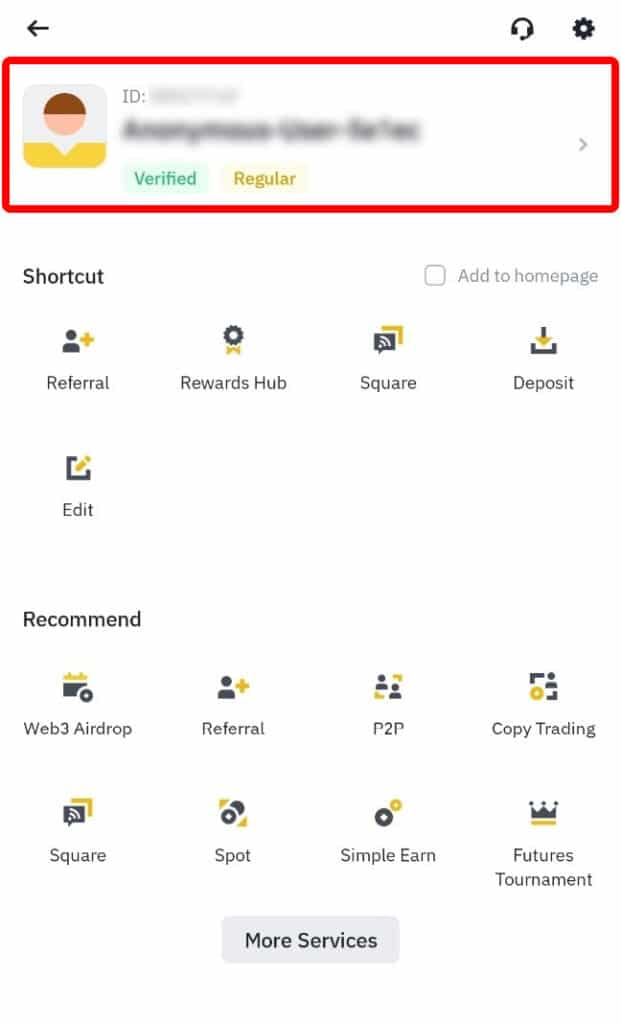

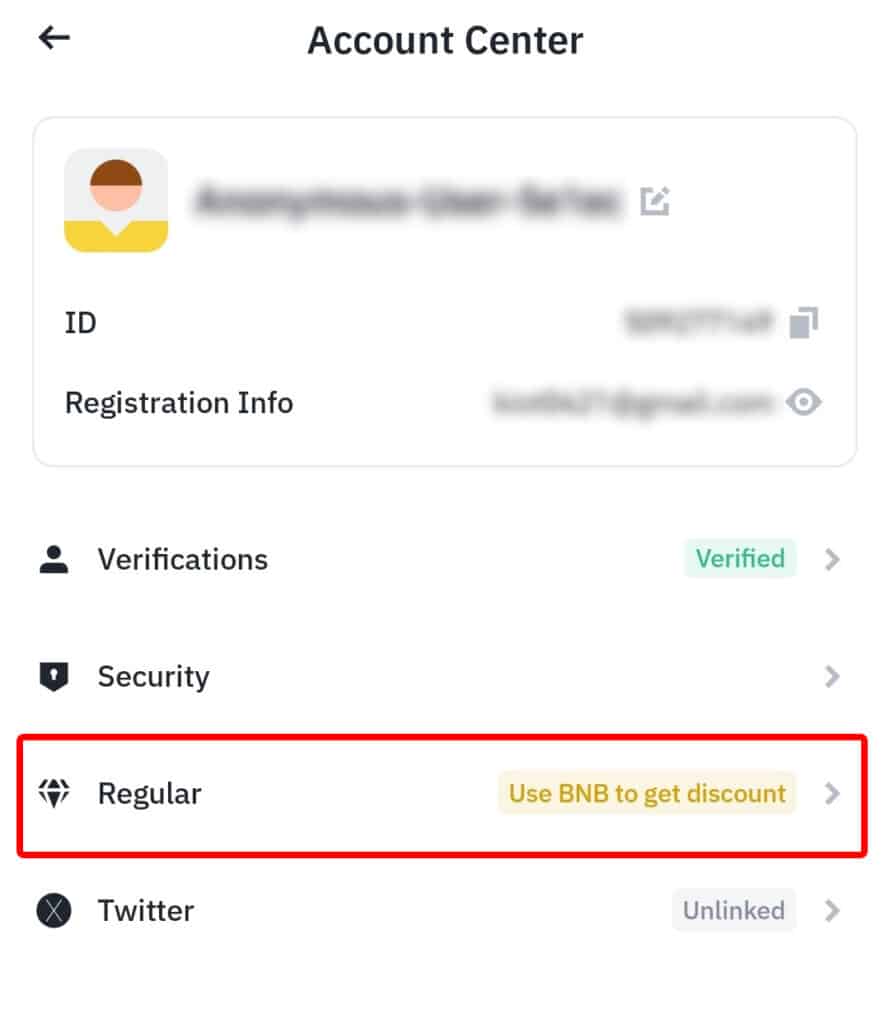

Account Center 이동

본인의 아이디와 유저명이 뜨는 곳을 눌러주세요.

누르면 Account Center로 이동이 완료됩니다. 여기서 [Regular]을 누릅니다.

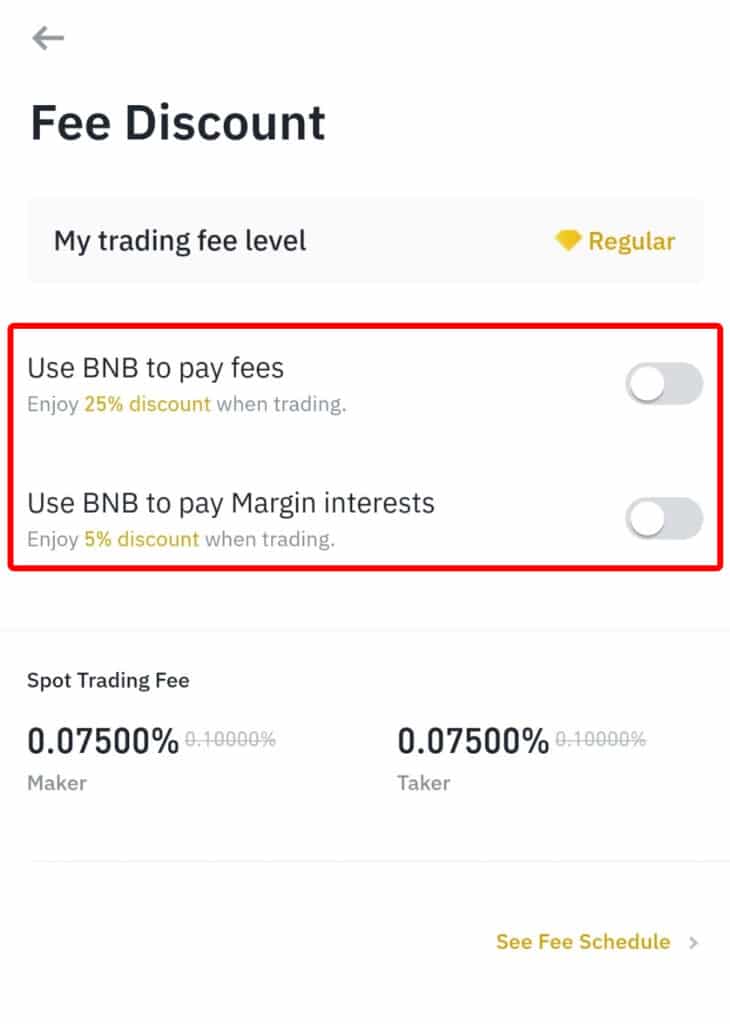

Fee Dicount에서 활성화하기

화면과 같이 뜨면, [Use BNB to pay fees] 와 [Use BNB to pay Margin interests]를 활성화 해주시면 수수료 할인 링크 20% + BNB 수수료 지불 할인 25%으로 총 수수료 45% 할인 혜택을 받으실 수 있습니다.

바이낸스 가입 방법, 수수료 45% 할인 받는 방법을 살펴보았습니다.

많은 분들이 수수료 할인을 받지 않고 가입을 하여, 처음에는 수수료에 부담감이 없다가

거래를 진행하면서 수수료가 생각보다 부담이 되는 경우가 발생합니다.

수수료 할인 링크를 통해 가입하시면 거래 수수료에 대한 부담감이 덜하게 되며,

수수료 비용을 아껴 투자를 더욱 적극적으로 할 수 있습니다.

그러니 꼭 수수료 20% 할인 혜택을 챙겨 거래를 하는 것을 추천드리겠습니다.